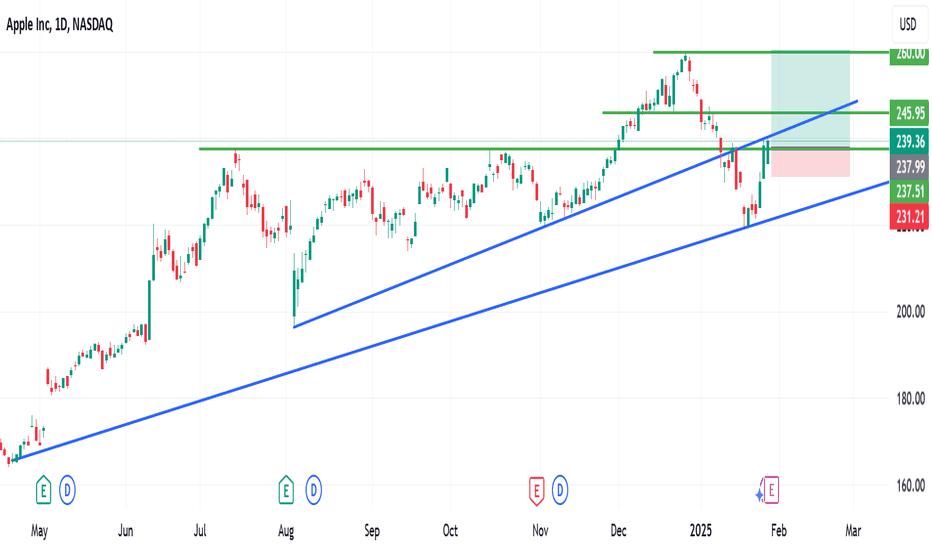

Apple (AAPL) Recovers 50% from Recent Deep

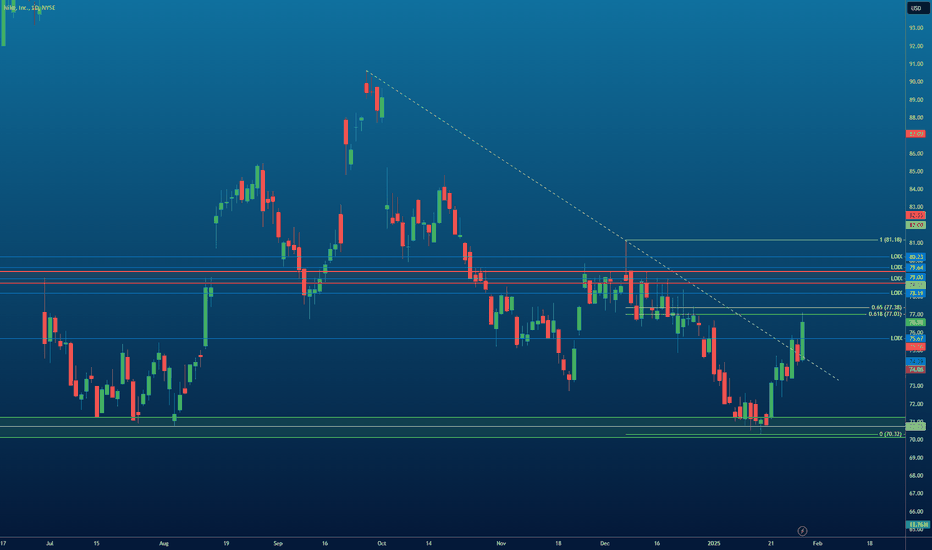

Apple (AAPL) Recovers 50% from Recent Decline – Technical Outlook & Forecast Apple Inc. (AAPL) has made a strong recovery after experiencing a sharp decline earlier this month. The downturn, which affected several major U.S. tech stocks, was largely triggered by the release of China’s AI model, DeepSeek, on the 21st. However, the broader market has since rebounded, regaining much of the lost ground. Technical Analysis AAPL is currently trading at a key technical level, the 50% Fibonacci retracement of its recent decline. This indicates a partial recovery from the previous drop, positioning the stock at a potential decision point for traders. Support Level: $231 Resistance Level: $260 Current Price Area: Near 50% Fibonacci retracement Trade Plan Given the recent recovery, I anticipate a potential pullback before further upward movement. My strategy is as follows: Entry: Waiting for a pullback to $237 Stop Loss (SL): $231 to limit downside risk Take Profit 1 (TP1): $260, aligning with resistance levels Conclusion AAPL's recovery from its recent dip suggests strong buying interest. However, market volatility remains a factor, so careful risk management is essential. Trade with caution and follow your risk strategy.

Read More